The White House is advancing a proposed rule that would allow the Internal Revenue Service (IRS) to access information on digital asset transactions conducted by U.S. taxpayers in foreign jurisdictions.

The proposal, submitted to the Office of Information and Regulatory Affairs (OIRA) last Friday, is part of an effort to enhance tax compliance related to cryptocurrency holdings abroad.

IRS Access to Foreign Crypto Transactions

OIRA, which operates within the Office of Management and Budget, evaluates federal regulations to ensure alignment with presidential priorities. The current review focuses on implementing the Crypto-Asset Reporting Framework (CARF), an international standard aimed at improving transparency for digital asset transactions.

The White House issued a comprehensive digital asset report this summer recommending the IRS and Treasury Department propose rules under CARF. The framework would require digital asset service providers to report certain transactions to regulatory authorities.

Goals of the Crypto-Asset Reporting Framework

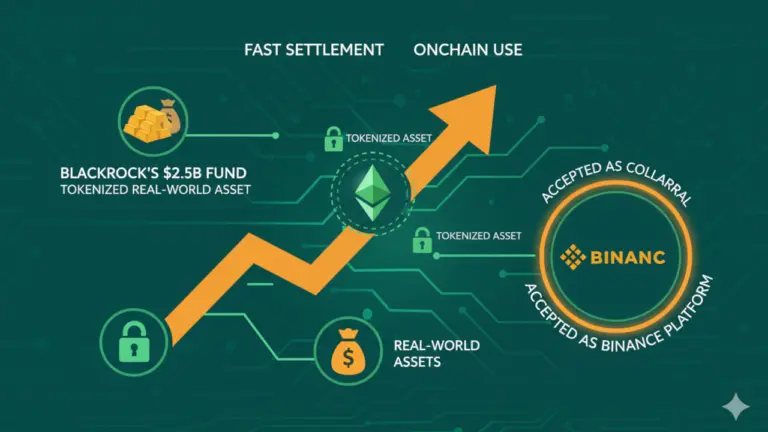

According to the White House report, adopting CARF-compliant regulations would discourage U.S. taxpayers from moving digital assets to offshore exchanges. It would also support the growth and usage of digital assets within the United States.

“U.S. regulations implementing CARF would discourage U.S. taxpayers from moving their digital assets to offshore digital asset exchanges,” the report states. “Implementing CARF would promote the growth and use of digital assets in the United States and alleviate concerns that the lack of a reporting program could disadvantage the United States or U.S. digital asset exchanges.”

Exclusion of DeFi Reporting Requirements

The report also clarifies that new regulatory rules should not introduce additional reporting requirements for decentralized finance (DeFi) transactions, maintaining a distinction in oversight between centralized and decentralized digital asset activities.