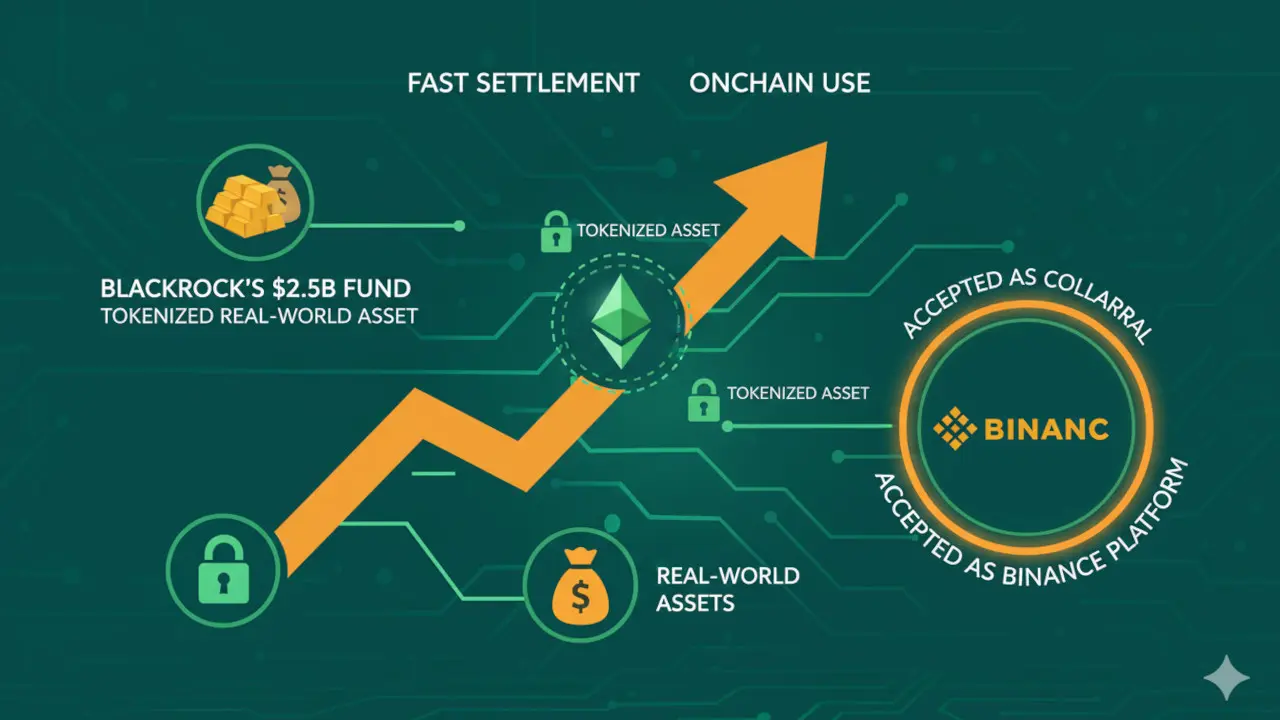

BlackRock’s tokenized U.S. Treasury fund, BUIDL, has been approved as collateral for institutional trading on Binance, the world’s largest cryptocurrency exchange by volume. The fund, issued by Securitize, offers traders a new way to leverage yield-generating assets while maintaining compliance.

In addition, Securitize is expanding BUIDL’s availability to the BNB Chain, enabling investors to use the token within decentralized finance (DeFi) applications and enhancing its interoperability across blockchain ecosystems.

BUIDL Approved as Collateral on Binance

Traders can now post BUIDL tokens as off-exchange collateral through a custody partner, rather than directly on Binance. This arrangement provides institutional clients with increased flexibility to hold interest-bearing stable assets while actively trading on the platform.

Catherine Chen, head of VIP & Institutional at Binance, said, “Our institutional clients have asked for more interest-bearing stable assets they can hold as collateral while actively trading on our exchange.” The move aligns with growing demand from institutions for compliant, yield-generating collateral options within crypto markets.

Expansion to BNB Chain Supports DeFi Integration

Securitize’s extension of BUIDL to the BNB Chain allows users to deploy the token in the chain’s DeFi ecosystem. This development broadens the token’s utility beyond trading collateral to include participation in decentralized finance protocols.

The integration is expected to increase BUIDL’s interoperability, enabling investors to access a wider range of blockchain-based financial services while leveraging U.S. Treasury-backed assets.

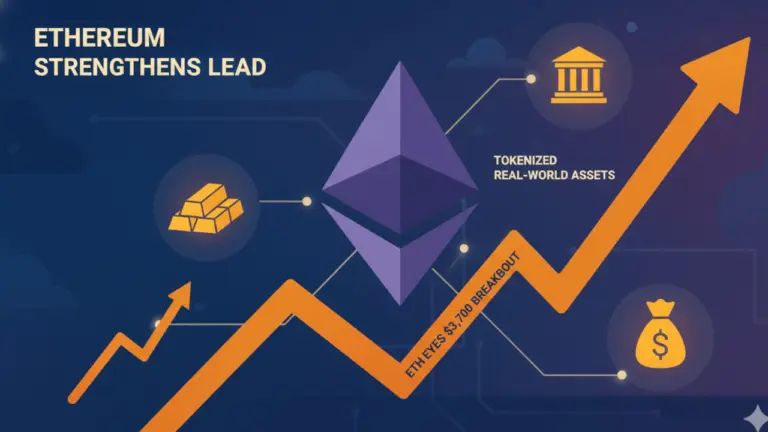

Growing Role of Tokenized Real-World Assets

Tokenized real-world assets (RWA) such as funds, bonds, and credit instruments are becoming more prominent within the crypto economy. Tokenized U.S. Treasuries provide investors with a way to earn yields on idle cash while maintaining exposure to traditional finance instruments on-chain.

These assets increasingly serve as reserve collateral for DeFi protocols, asset management, and trading activities, bridging conventional finance with digital markets.

Industry Leaders Highlight Traditional Finance Integration

Robbie Mitchnick, BlackRock’s global head of digital assets, emphasized the significance of this development: “By enabling BUIDL to operate as collateral across leading digital market infrastructure, we’re helping bring foundational elements of traditional finance into the onchain finance arena.”

BUIDL distributes yields to token holders derived from its underlying U.S. Treasury holdings. Since its launch in March 2024, it has amassed approximately $2.5 billion in assets, making it the largest tokenized money market fund available on public blockchains, according to RWA.xyz data.