Michael Saylor‘s company, Strategy, purchased 397 Bitcoin valued at approximately $45.6 million last week, marking a notable slowdown in its buying pace compared to previous months.

According to a Monday filing with the U.S. Securities and Exchange Commission (SEC), Strategy acquired the Bitcoin at an average price of $114,771 per coin. This latest purchase increased the company’s total holdings to 641,205 BTC.

Strategy’s Bitcoin Holdings and Purchase Trends

Strategy has acquired its Bitcoin holdings for a total of $47.49 billion, averaging $74,047 per coin. The company’s Bitcoin yield stands at 26.1% year-to-date, as stated in a Monday post on X by Strategy.

Last week’s purchase is part of a slower accumulation trend. In the previous week, Strategy bought 390 BTC for $43.3 million. This brought October’s total acquisitions to 778 BTC, one of the smallest monthly purchases in recent years.

By comparison, Strategy acquired 3,526 BTC in September, a figure 78% higher than October’s total.

Institutional Demand and Bitcoin Price Recovery

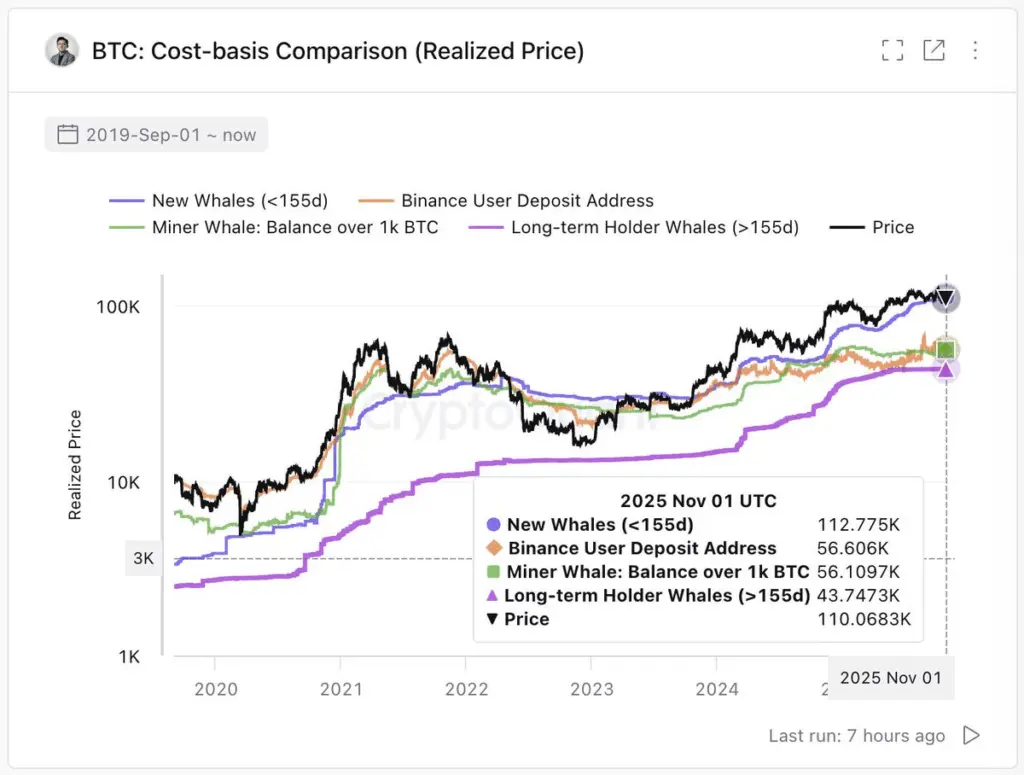

Analysts caution that the reduced buying pace by Strategy could impact Bitcoin’s price recovery. Institutional demand, primarily driven by Strategy and U.S. spot Bitcoin exchange-traded funds (ETFs), has been a key factor supporting Bitcoin prices throughout 2025, according to analytics platform CryptoQuant.

CryptoQuant forecasts that Bitcoin’s price may struggle to return to previous highs until large-scale purchases by these entities resume.

Ki Young Ju, founder and CEO of CryptoQuant, noted in a Sunday post on X: “Demand is now driven mostly by ETFs and MicroStrategy, both slowing buys recently. If these two channels recover, market momentum likely returns.”