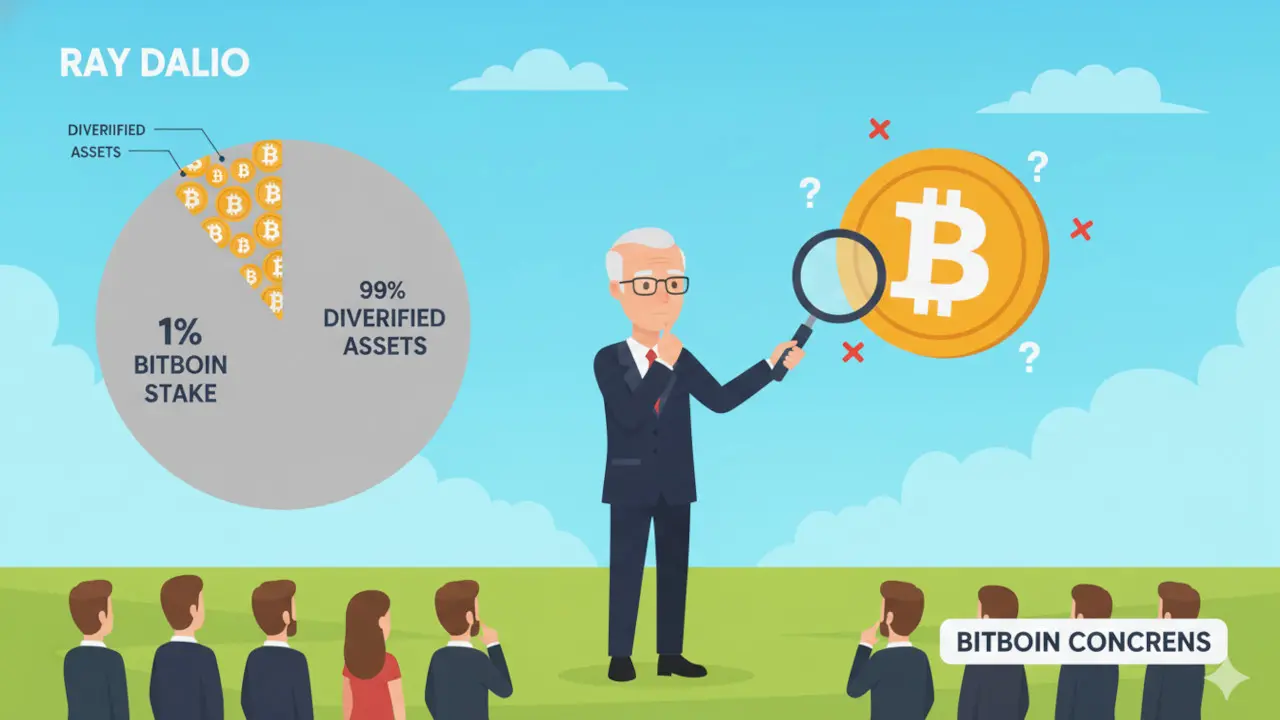

Bridgewater Associates founder Ray Dalio confirms that bitcoin makes up about 1% of his investment portfolio. Despite holding the cryptocurrency for years, Dalio points to significant hurdles that prevent bitcoin from becoming a global reserve asset.

Dalio identifies traceability, transactional transparency, and the emerging threat of quantum computing as key issues limiting bitcoin’s adoption by major governments. He also reiterates his preference for gold as a more reliable asset.

Dalio Confirms Bitcoin Stake and Highlights Structural Challenges

On Thursday, Dalio told CNBC that bitcoin has consistently represented roughly 1% of his portfolio. While he acknowledges owning the digital currency, he emphasized it faces obstacles that make it unlikely to serve as a reserve currency for major nations.

“I have a small percentage of bitcoin,” Dalio said. “I’ve had it forever, like 1% of my portfolio.” He pointed out the inherent traceability of bitcoin transactions and the risk posed by advances in quantum computing, which could potentially compromise the cryptocurrency’s security.

Concerns Over Traceability and Quantum Computing

Dalio explained that governments are unlikely to adopt financial instruments that maintain public, permanent transaction records. He warned that bitcoin’s traceability makes it less attractive as a reserve currency.

He added, “It could be, conceivably with quantum computing, controlled, hacked, and so on and so forth.” These vulnerabilities raise doubts about bitcoin’s long-term viability as a global monetary standard.

Preference for Gold and Portfolio Allocation Advice

In a recent statement, Ray Dalio suggested investors consider allocating 15% of their portfolios to a combination of bitcoin and gold. However, he expressed a clear preference for gold, citing its tangible nature and independence from third-party providers.

“The advantage of gold is that it’s an asset you can hold, and you’re not dependent on someone to provide it,” Dalio said.

Broader Economic Warning on Bubble Risks

Beyond cryptocurrency, Dalio issued a warning about the U.S. economy, stating it is approximately 80% into a bubble reminiscent of those before the 1929 crash and the 2000 dot-com bust.

He based this assessment on his proprietary bubble indicator, which analyzes data dating back to 1900, including leverage, money supply, and wealth concentration metrics.

“The picture is pretty clear, in that we are in that territory of a bubble,” Dalio said, highlighting potential vulnerabilities in the current market environment.