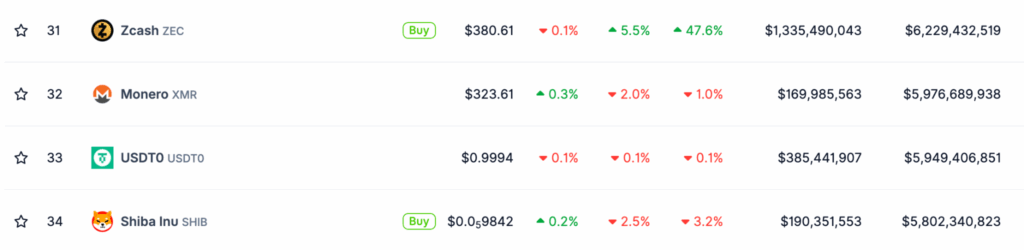

Zcash (ZEC) has overtaken Monero (XMR) to become the leading privacy-focused cryptocurrency by market capitalization. Zcash’s total value has surpassed $6.2 billion, edging past Monero’s $5.9 billion.

This marks a remarkable turnaround for Zcash, whose market cap was just $800 million as recently as September.

Over the past 24 hours, ZEC’s price has risen 7%; over the week, it has climbed 49%; and over the past month, it has surged more than 91%. At the time of writing, Zcash is trading around $387 — its highest level since 2018.

Monero’s performance has been more subdued. The coin’s price dropped 2.3% in the last 24 hours but remains 8.8% higher over the past 30 days, trading at $323 at the time of writing.

Why Is Zcash Rising?

One of the early catalysts behind the rally was the launch of the Zcash Trust by Grayscale, which drew renewed investor attention. Market observers also point to growing legislative pressures that could threaten user privacy, driving more demand for privacy-preserving assets.

According to Matt Henderson, former product manager at Near Protocol, the recognition of Zcash’s reliability and technological maturity among experts has further strengthened its position in the market.

Even some Bitcoin maximalists have described Zcash as an “improved version” of the original cryptocurrency. In their words, the privacy coin is finally ready for mass use.

“Initially the project offered cutting-edge privacy technology, but then the team had to adapt it for everyday use cases. Until recently it was technically impossible to make shielded transactions in mobile wallets due to high computational requirements. The situation changed with the arrival of the Zashi and Edge wallets,” one user noted.

Another factor fueling the rally is growing liquidity, Henderson emphasized. The volume of shielded transactions recently hit a record 4.9 million ZEC, a development that Helius Kab CEO Mert Mumtaz described as “one of the craziest in the history of cryptocurrencies.”

Zcash has also received support from several prominent figures across the crypto industry.

Outlook

In the longer term, former BitMEX CEO Arthur Hayes expects Zcash to rise to $10,000, and in the short term to $400.

According to Cal, a researcher who follows the project closely, ZEC’s future upside depends on Bitcoin’s trajectory. If the leading cryptocurrency resumes its rally, Zcash could reach $1,000 by the end of the fourth quarter.

Some investors note that “buying ZEC at $380 is like buying bitcoin at the same price,” suggesting that market participants see significant upside potential.

“Every holder of the first cryptocurrency will look like a genius by 2030 if they invest at least 1% of their portfolio in ZEC today,” users also say.

Still, not everyone shares the optimism. CryptoQuant analyst Burak Keshmechi has cautioned that ZEC’s current upswing may be temporary.

On October 28, the Zcash project celebrated its ninth anniversary — just as it reemerges at the center of renewed market attention.